CBDCs — Why Governments Cheer and Humanity Suffers

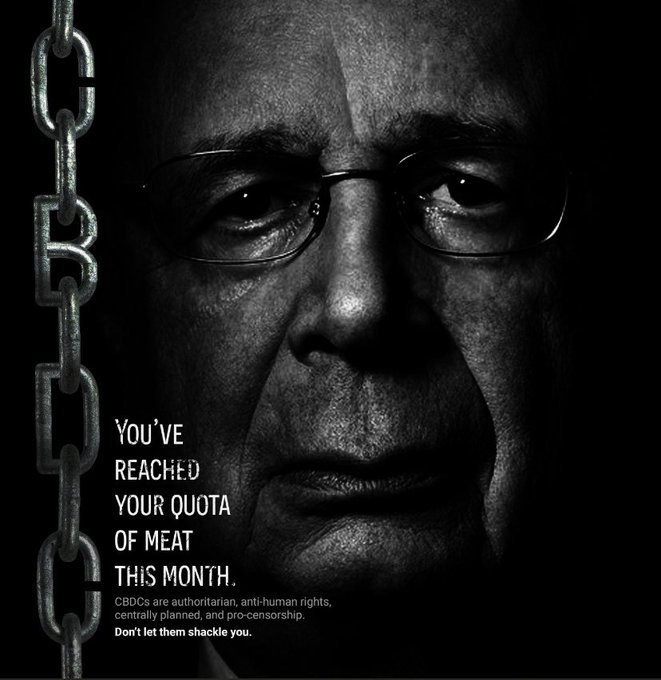

CBDCs are authoritarian, anti-human rights, centrally planned, and pro-censorship.

It seems as if the money supply in the United States and Europe only knows one way to go: up. According to the European Central Bank, the money supply M1, i.e., the amount of cash and savings with immediate access, increased by more than 14.5% in November 2020 compared to the previous year. Admittedly, next to the Venezuelan bolívar, this is still a small expansion, but it is also not unusual for a currency that is created out of thin air.

For decades, states have been financing their expenditures for wars, "generous" election gifts, inefficient bureaucracies and their debt relief not only by taxing and effectively stealing from the population, but also by expanding the money supply, and thus again at the expense of the "common people," savers and taxpayers. Furthermore, through manipulation of the interest rate by central banks, they cause massive damage to all the people who are subject to their monopoly on money. Low interest rates have advantages for states and large corporations. They can replace expensive loans with cheaper ones and thus get out of debt. On the other side are the people for whom saving is no longer an option or whose savings are threatened by negative interest rates.

Recently, one could have observed a trend in people’s behavior. Instead of putting money aside, people prefer to spend it immediately, thus becoming the consuming, dumbed down individual the World Economic Forum wants them to be. But who could blame these people? If the money of the saver does not bring in any more positive interest and is rather devalued by inflation, there is no incentive on a long-term basis to invest. The result is not only environmental pollution, but also the failure to make provisions for old age and crises. Consumption increases and investments in one's future decreases, ultimately leaving you dependent on the state.

The Eleven Qualities of Good Money

Now, with CBDCs, we must first consider the existing advantages and disadvantages of cash for the rulers and the ruled. The advantages for the ruled are often the disadvantages for the ruler and vice versa.

For the user, there is an advantage if his medium of exchange is universally accepted, portable, durable, homogeneous, divisible, malleable, recognizable, and stable in value. Anonymity, freedom from censorship and authorities’ inability to confiscate money are also becoming increasingly important in states that are increasingly becoming encroaching.

If we now look at the banknote in our wallet, we will see that only a few of these properties still apply to it. The Euro and the US Dollar are still generally accepted, after all. But if we are looking at the Venezuelan bolívar, we must come to the realization that this can change quickly. It is also portable, reasonably durable, homogeneous, and recognizable. What has already been eliminated after the omission of gold and other precious metals as money is divisibility, malleability and, above all, value stability, as already demonstrated above by inflation and the preference for immediate over future consumption.

But what about anonymity, freedom from censorship and unconfiscability? Printed banknotes still fulfill these qualities of money today. After all, it is still possible to shop anonymously and without censorship. Unconfiscability depends largely on how well one can hide one's money, but it is not entirely impossible. However, it is adversely affected by devaluation due to inflation. Therefore, one can only award half a point to the Euro or US Dollar. You could only award a full point if there were no expansion of the money supply or currency reforms.

For the ruling class, some of these remaining advantages are of course a massive disadvantage to them. They can hardly introduce negative interest rates, since a bank run would be the logical consequence. Likewise, they cannot monitor with whom and how the people trade with others. Physical portability, anonymity, freedom from censorship, and unconfiscability block the way for them controlling who trades with whom on what terms, who spends their money on what, and how well they can access it when they deem it necessary to redistribute or expropriate something. So, the remaining advantages of printed banknotes are a real issue for them.

CBDCs are Nothing but a Tool for Control

Let us now finally turn to CBDCs. Even though the European Central Bank and the US Federal Reserve try to explicitly emphasize that they do not intend to abolish cash completely—“Nobody has any intention of building a wall”—, their argumentation is rather weak. One could even say they are having a really hard time cooking up compelling propaganda to bait people into using CBDCs. And besides them — again — abusing your kids by telling you how you will be able to control that they won’t buy fast food, the only main argument they can think of for the digital Euro/Dollar is “convenient, cashless payment.” We have already had this for decades with credit, debit and — in Europe — EC cards, recently with the addition of even more “convenience” altruistically delivered by Big Tech (Apple Pay, GooglePay, etc.). Thus, they cannot provide a single compelling argument for the introduction of CBDCs. Supposedly, the so-called “E-Euro” or “Digital Dollar” will exist in parallel with cash. But even this parallel existence opens the door to the abolition of cash, which can be ostensibly justified in the future. In the event of a loss of confidence in banks, the threat of expropriation or negative interest rates, a bank run could take place. This could be countered by only allowing withdrawals to the digital wallet instead of cash. However, these could also be expropriated and charged negative interest.

It is also conceivable that political opponents or disobedient individuals could be excluded from payment transactions by simply blocking their digital wallet for some or even all payments. The Chinese social credit system comes to mind. What then remains in terms of the quality of money is merely general acceptance and recognizability, and acceptance is only guaranteed by the fact that the respective CBDC will be the only means of payment to be accepted.

Recognizability, which was originally only intended to ensure the authenticity of the money by buyers and sellers, is extended by the insight of the state. This makes the user as transparent as possible. Thus, the state recognizes the interests, political convictions and other behaviors of the users and can misuse them to their disadvantage.

In summary, of the eleven qualities that good money should have, only recognizability and homogeneity remain. This means that nothing is blocking the path for governments to enact total control over its citizens. In my opinion, there can and will be complete transparency as to what we do with our money, where it is stored, whether we have acquired precious metals or Bitcoin, sweetened our weekend with an escort lady, or simply which type of ice cream we prefer to buy. What is rightly criticized about loyalty point systems like airline miles or hotel credits is then the status quo that no one can escape. In addition, expropriations and devaluations up to the complete loss of purchasing power and even politically motivated exclusion from payment transactions are possible. Whether and how you as a citizen can escape this system, I am going to clarify in another article. Subscribe to stay in the loop.